Brazil’s PIX and the parallels with UPI (#43)

One year in: Impressive beginning and what's next

Welcome to the 43rd issue of Unit Economics. For today’s issue, I go deeper into the year-old real-time payments system of Brazil - Pix - and attempt to understand where it stands versus UPI. Dive in!

Brazil and India are often – for good reason - bracketed into the same column by economists. Formalized better with the BRIC acronym in the early 2000s, the two countries have consistently – with a growing middle class - shown promise of progression towards advanced economic development. This is only to suggest that given the positions of the two, their monetary and fiscal strategists likely benchmark themselves against those in the other country.

So, when India’s new real-time payments system – UPI - made big splashes in the months following the 2016 launch, I can only imagine that a few heads would have turned at Brazil’s central bank, Banco Central Do Brasil.

For instance - UPI, which saw 2Mn monthly transactions in Dec ’16, had grown exponentially to 150Mn monthly transactions by Dec ’17. The system was validated further with the doubling of participant banks within those twelve months. This, obviously, was not lost on Brazil’s central bank, who around the same time set up a working group of more than 130 financial services firms to investigate the development of an instant payments system in the country.

In Dec ’18, the working group released the Guidelines for the Brazilian Instant Payments Ecosystem, which briefly covered the basic characteristics of the proposed ecosystem. And as the next steps, it particularly focused on the development of a single and centralized settlement infrastructure. This was on top of the STR, an existing real-time gross settlement (RTGS) system, handled by Banco Central Do Brasil (BCB) for a decade and a half. In comparison, UPI simply adopted the rules and regulations of the existing Immediate Payment Service (IMPS) for settlements.

By Feb ’20, BCB had officially launched the brand name – Pix – and mandated that the instant payments system be adopted by all financial institutions with more than 500,000 active customer accounts. For those with a lower number of active accounts, participation in Pix was kept voluntary. On the other side, by Feb ‘20, UPI had already grown to process over 1.3Bn monthly transactions.

Impressively, BCB was able to fully operationalize the Pix in Nov ‘20 with over 700 network participants and a new real-time gross settlement system - Sistema de Pagamentos Instantâneos (SPI). This was within the two years of the Guidelines being published by the working group.

By the end of 2020, i.e. within only two months of launch, Pix was settling ~144Mn monthly transactions – a feat that took UPI more than 1.5 years to achieve. This adoption was undoubtedly unexpected, and best summarized by Roberto Campos - the president of BCB - who said that to get this amount of daily transactions, in an optimistic view, would take months, even over a year. But for Pix, it only took a few weeks.

Now, since a year of its launch, Pix continues to throw up incredible numbers. In Nov ’21, for instance:

Pix settled over 1.2Bn monthly transactions, compared to UPI’s 4.2Bn. But – and you would hardly believe it - the value of monthly transactions settled by the two systems is already similar at $95-105Bn (!).

The registered users in the centralized database for Pix rose to 115Mn, i.e. to more than half of the country’s population. In addition, Pix processed 30X more transactions than Brazil’s second-most used electronic payment system.

Impressive, without a doubt.

But, what makes Pix tick?

It helps that from day one, Pix has had high aspirations: (1) allowing transactional accounts to users in the form of current, savings, or prepaid payments accounts and (2) allowing fund transfers for multiple use cases, including from businesses to businesses (B2B) and from businesses to government (B2G). Combine this almost 725 market participants on launch and it meant that the central bank, without anticipating it, gave Brazil a chance to allow this scale.

But what pushed people to use Pix? For one, the Central Bank of Brazil structured Pix to allow transactions 24 hours a day, 7 days a week, and targeted transaction authorization within 10 seconds. This allowed Pix transactions to be settled faster than with any other payment method in Brazil. The speed further helped make finances more liquid for payees and reduced settlement risks that are associated with net interbank transfers. Win-win.

In addition, a system of fewer intermediaries meant lower financial costs for businesses, inspiring merchants to accept Pix. And there are few better ways to push payments than to get merchants on your side.

Finally, what really separated Pix from the rest is how easy it made initiating a payment, i.e. through a QR code or a Pix key. To understand, however, how a transaction with Pix works, let’s first make sense of the intermediaries involved.

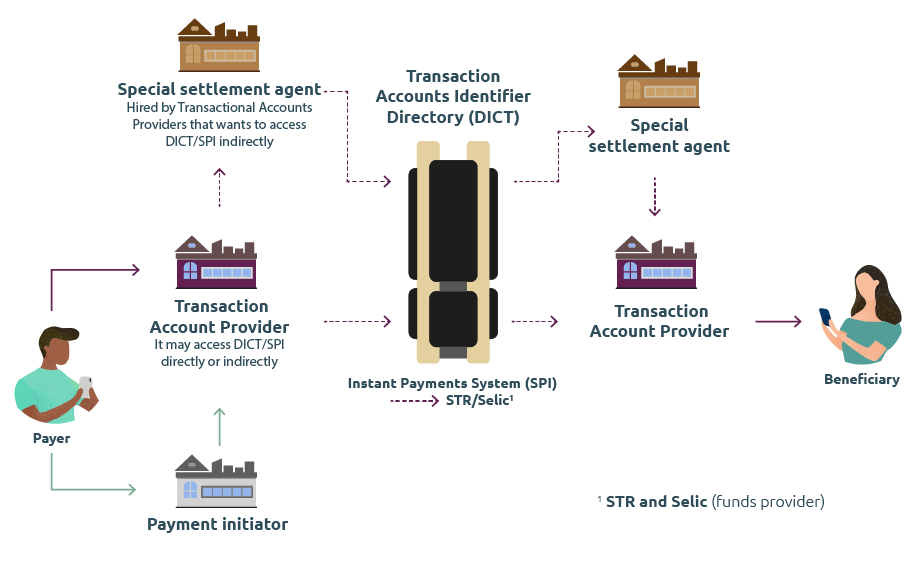

Banco Central Do Brasil (BCB)

BCB is primarily responsible for rule-setting and the supervision of participants within Pix. Importantly, it also operates the two system infrastructures:

Transaction Accounts Identifier Directory (DICT): the database that links the keys/aliases to the users' transactional account. An alias is similar to the Virtual Payment Address (VPA) associated with a savings or overdraft account on UPI (more on this later).

Instant Payments System (SPI): the RTGS infrastructure that settles transactions between different institutions within a few seconds and allows participation of both direct, i.e., institutions regulated by BCB, and indirect, i.e., institutions not regulated by BCB, participants.

Tellingly, the rulebook on Pix also required that the participants offer the end-user — through a safe, simple, and intuitive experience — a convenient way to carry Pix's transactions: initiation, reception, return, end-user authentication; as well as Pix alias's registration, deletion, portability, and ownership claim. This requirement signals an unusual focus towards customers, which appears as a key principle around most Pix rules.

In addition, BCB, along with its advisory committee - Pix forum, has been able to skilfully enable an open ecosystem, allowing participation from a broader range of financial institutions than is common to real-time payments systems around the world. The three types of institutions that it allows make this clearer.

Transaction Account Providers

The first of the three, the transaction account providers are financial or payment institutions that provide transactional accounts (current, savings, or prepaid accounts) to the end Pix users. An account provider can access DICT and settle transactions with SPI directly on qualifying the legal requirements, or indirectly with the help of a direct participant (for DICT) / special settlement agent (for SPI).

By Nov ’21, the number of transaction account providers under Pix had risen to 755, with more than 83% of those participating indirectly, i.e. with the help of direct participants and settlement agents. Moreover, of all institutions, more than 610 participants are Credit Cooperatives – compared to only 60-65 banks. In comparison, for UPI, transaction account providers for end-users continue to be large banks, with third-party applications driving acquisition for the majority.

Special Settlement Agent

These are newly created institutions that are authorized by BCB and that voluntarily participate in Pix to provide settlement services to other participants (indirect). There are only four such agent institutions in Pix, and none provide payments services to Pix end users.

Payment Initiator

Licensed payment institutions that initiate transactions on a customer’s request. The customers must hold transactional accounts in another financial or payments institution since the Payments Initiator institutions cannot provide the service. This is similar to how the third-party application providers in India enable users to initiate transactions over UPI using transactional bank or overdraft accounts.

Now that we know the parties to a transaction, how does a transaction actually happen?

It is simple, really. To make a Pix, a payer must first access the application of the financial or payment institution connected to the user’s transactional account. And then make payment through either of the means:

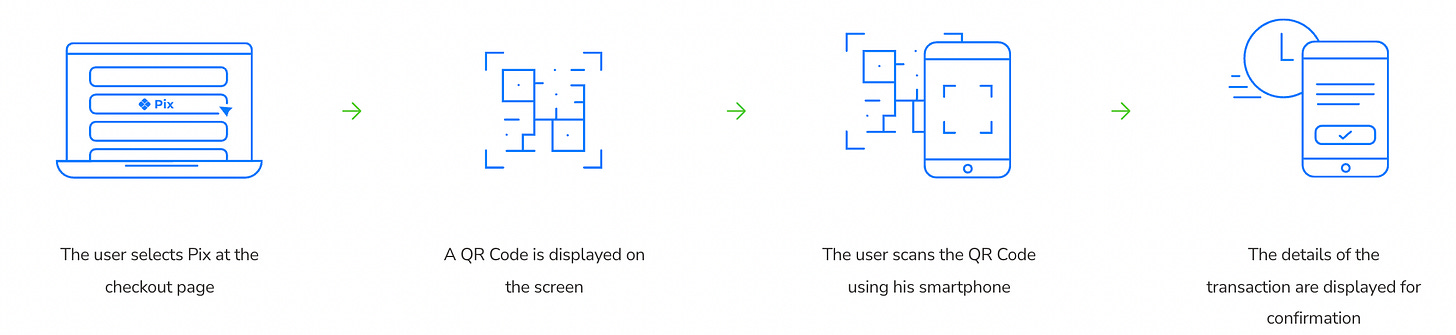

QR code

The QR codes, which follow a BR code standard, can be static or dynamic and are required to be scanned by the payer. This is a common method of paying at the point-of-sale or when making an online transaction through web checkout, wherein Payer’s application processes the transaction details on scanning the dynamic QR.

Pix alias or address keys

A payer can also type in a Pix key or alias, which can be a mobile phone number, an email address, the Taxpayer Identification Number (CPF or CPNJ), or a randomly generated alphanumeric string.

The alias, on the end user’s request, is linked to the user’s transactional account within the DICT by the Pix participant. Further, at the user’s discretion, five aliases can be assigned to each transactional account – with the condition that a unique alias be associated with only one transactional account. For example, the same mobile number cannot be linked to two transactional accounts.

Legal entities are afforded greater flexibility, with the option to assign up to 20 aliases to each transactional account.

This implies that, often, users have multiple keys registered for Pix. And as per the latest data, for 115Mn users, more than 364Mn keys were registered in DICT by Nov ’21. The image below shows that more than a third of the registered keys are random, followed by CPF and phone number in the order of preference.

Once the payee’s Pix key is known, paying through Pix is as simple as entering the key and pressing confirm. The transfer does not even necessitate the payer to have a registered Pix key, i.e. the payer can continue to use the existing bank account information as he/she would have for other electronic methods (DOC, TED – used in Brazil). Moreover, to make the process more seamless, there is no additional authentication factor required to confirm payment. Instead, the system relies on the authentication as necessitated by the financial or payment application (usually at the login).

The convenience of QR codes and Pix keys are reasons enough for popularity against other methods. But what else does Pix do differently?

There is no assigned minimum or maximum transaction amount limit for Pix transfers, except for certain exceptional cases. In comparison, there are strict cooldown and post-24 hours transaction limits on UPI. Instead, BCB allows participating institutions to establish maximum limits on a per transaction or a daily/monthly basis as per their evaluation of the fraud risk. This is likely why B2B transactions – traditionally of high-ticket sizes - drive more than 35% of all Pix transfer amounts, despite making up less than 3% of the number of all platform transactions.

Pix has, within, one year contributed to the financial inclusion of over 45Mn Brazilians, which was one of the key goals laid down by the BCB. In addition, certain analysis indicates that more than 62% of the adult population in Brazil has made at least one Pix, with the number already higher than the percentage of Indian users that have done a UPI transaction.

While the individuals are exempted from being charged on making or receiving a Pix, except for certain cases, the financial institutions are free to charge a fee for sending or receiving money via Pix to legal entities. This encourages institutions to monetize via non-P2P transactions, which is a challenge over UPI given the strict controls on MDR, and consequently, interchange.

The structure of the Pix ecosystem appears highly distribution-driven, with incentives well spread out for individuals, merchants, and financial institutions. But with freedom on authentication, transaction amounts, and fees offered by BCB, Pix is exposed to significant systemic risks.

One such risk is a lift in crimes, especially for a country prone to them. With the launch of Pix, there has unfortunately been an increase in lightning kidnappings, wherein people are held hostage and forced to transfer money via Pix. The issue has extended to such heights that a new bill in the state of São Paulo recently proposed suspension of instant payments until measures for prevention of such crimes and other frauds were put in place.

But given the political backing for Pix, there are likely to be softer measures instead. It does, however, point out the risk of leaning towards convenience at the cost of security.

What’s next for Pix?

The views on Pix continue to be overwhelmingly positive, especially with the migration from cash during the pandemic. With the FIS report suggesting a decrease in cash usage at point-of-sale by 25% (2020), some of the displacement towards Pix is expected to be permanent. In the same vein, it appears likely that Pix continues to evolve mainly as a debit alternative, with none of the benefits on rewards or delays of credit cards yet afforded to the payment method.

For Carlos Eduardo Brandt - a department chief at BCB and the brains behind Pix operations - and Campos Neto, Pix has only reached 5% of its potential yet. As for what’s next, Pix is working to soon (1) support international transfers, (2) launch prepaid Pix cards, and (3) support financial inclusion through offline transactions. Parallels for all three can be found in the progress made by NPCI with UPI. Further, more than 3/4th of all Pix transactions continue to be P2P – implying room for higher merchant transactions. The central bank would also hope that Pix enables Fintech firms in Brazil to build accessible services on top of the payment system, and perhaps replicate the success of Nubank.

Finally, given the progress of UPI on e-mandates and of the ongoing cross-border linkages of real-time payment systems (PayNow and UPI, for instance), we can expect Pix to naturally progress on both fronts. And, someday, we might see Pix and UPI partnering for cross-border transfers – entering a Pix key, perhaps, to send payments to merchants in Brazil from India. Meanwhile, lots of us will continue to keenly watch the progress of both payments systems, which appear as transformative as any other technological advancements of our time.

If you have any views or feedback to share on the topic, feel free to add a response below or to share your thoughts with me over Linkedin. In case you feel your friends or family would be interested in reading about payments, feel free to share the blog with them as well. See you in a couple of weeks!