Carbon Credits and Sustainable Payments (#29)

Also: role of payments in driving sustainable consumption and some helpful covid-19 resources

Welcome to the 29th issue of the Unit Economics. Parts of the world, and India particularly, have turned sombre in the last two weeks. And if you are feeling stressed or a little helpless, know that there are thousands of people working to lend a helping hand. I have shared a few of the key medical and support resources at the end of this article. If you feel that talking about payments can help you, please feel free to reach out to me as well :)

With all that is ongoing, the write-up today is relatively short but on a topic that is relevant and likely to make you wonder. Here we go!

I will start by sharing a few statistics that are quite revealing:

Roughly 85% of the global population is willing to take personal action to combat environmental and sustainability issues today

62% of the consumers would consider switching from their bank to an eco-conscious bank

More than 50% of the consumers would pay an additional fee if the products are sustainable

The stats tell us of the shifting preferences towards eco-conscious consumption. For one, the decision-making power is moving in the hands of the more environment-friendly millennials and Gen-Z’s. And two, we know that people have also, undoubtedly, become more aware of their frailty and environmental impact due to Covid-19.

Now, when consumers talk about eco-conscious consumption, the burden of changing habits shifts to the brands that see this as an equal opportunity and responsibility. However, as companies mend ways to fit the narratives – payments stand in an envious position.

Think of it this way: a payment is an identifier that a consumption – in the economics lingo – has taken place. The act of transferring money may be little or big but remains a part of almost all customer value chains. Naturally then, owing to the idea of how we have built our institutions, payments assume an important position to impact the environmental outcomes of our spending. This, rather simple, realization poses an important question.

How can payments drive sustainable consumption?

In the small train of thought, we realize that payment companies share the burden of sustainable consumption in a more parental form by contributing to huge volumes of purchases.

The big payments companies have come to understand this responsibility for the brands that they are:

Mastercard has pledged net zero emissions by 2050, issued a $600 Mn sustainability bond, formed a coalition to plant 100 Mn trees, among other initiatives

Visa has further committed to net zero emissions by 2040, issued a $500 Mn sustainability bond, and has earlier reached the 100% renewable electricity

American Express achieved zero net carbon emissions in 2018 and has set ambitious energy, water, and sourcing goals for 2025

Stripe has also gone down the route of achieving carbon neutrality and has even launched an ingenious carbon removal product that allows companies to set aside part of their revenue towards environmental goals

Developments do not end with the big players. In fact, most of the customer-side innovations in eco-conscious payments, and not just on the company’s operational emission targets, are coming from new payments companies and banking products.

RHB Malaysia launched a recycled plastic card last year that donates to support marine life as you spend. Tred offers a card that helps you plant trees and track carbon emissions. Bunq plants a tree for every 100 Euros you spend with its Easy Green program and helps track your forest and carbon emissions. Currensea allocates a proportion of your savings towards planting a tree. And there are more examples.

My gut sense is that the growing trend towards eco-friendly payments is not a small feature that you can leave for later in your roadmap. These initiatives will soon turn into must-haves for your customers. And in this challenge, the role of payments companies is likely to shift as well. Such companies will realize the need to not only facilitate payments but also monitor and help their users make smarter choices.

In essence, the responsibility towards sustainable consumption will be embedded into every step of how customers make their purchasing and payment decisions.

We have already seen a few great examples of how companies like Tred and Bunq are doing that. Below, I try to summarise broadly the initiatives running today and share how companies can further help consumers make more informed eco-friendly choices:

Track Carbon Emissions

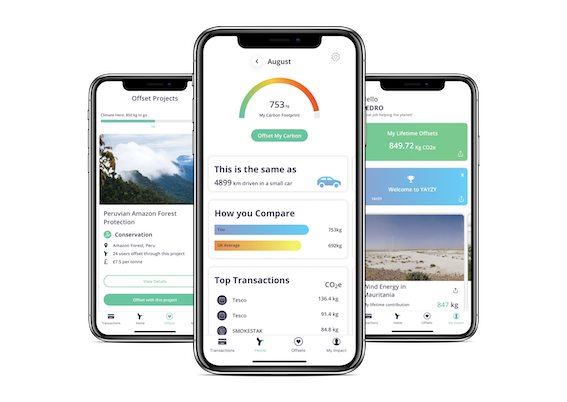

Consumers do not only want to help plant trees, but they also want to learn how their actions are harming the environment. For payments companies, that implies tracking the carbon footprint of the purchases that users make. Yayzy does that by linking to your bank account to estimate the environmental impact of what you buy. Tred aggregates all your cards to convert the pounds you have spent to kilograms of carbon emissions. Klarna, with over 90 million users, has also started offering the option to monitor carbon footprints. Only a matter of time before this becomes pervasive.

Reimagine Rewards: From Planting Trees to Carbon Credits

Once consumers identify the harm they are doing to the environment, many would immediately feel the need to offset it. This is where companies can get innovative. Bunq, we saw, plants a tree for every 100 Euros spent. Tred gets more creative and connects the carbon spending of customers to a voluntary subscription payment service, wherein the subscription money would be used to plant trees. With Yayzy, consumers can offset their carbon footprint through Ecosphere Plus and even get tips in-app on the environment-friendly lifestyle brands nearby to purchase from. And interestingly, Currensea saves you fees on foreign expenses and allows you to donate part of these savings to offset carbon emissions.

We can see the two challenges that payments companies might face here. One, they are not sure whether the users want to offset their carbon footprint or not – and if they want to, to what extent. Two, building the carbon offsetting initiative in-app requires the company to detail what the ‘offset’ maths would be.

In both cases, the easy solution is to partner with a dedicated carbon offset organization that allows users to voluntarily contribute and defines neatly the redemption mechanism. Discover – a large credit cards brand – has recently done that by partnering their Cashback Rewards with Carbonfunds.org that allows consumers to donate their cashback bonus to plant trees with a simple $1 Cashback = 1 Tree redemption option.

The bigger point here is that rewards and redemptions for payments have largely remained the same-old for the past decade, and with this trend - there is room and direction for innovation. For example, companies can do much to reward users that are making better eco-conscious purchases. They can also make the rewards personalized and offer multiple causes – reforestation, marine life support, research support – for the consumers to donate to and choose from. Not all of these would offset carbon emissions, but they do play a part in improving our environment.

Eco-Friendly Cards

Cards drive engagement and loyalty. And there is little surprise in their growing popularity as the fintech players fight to build a network by issuing a more stylish version of their own cards. Numberless, signed, colourful, metallic, and whatnot. Everyone is reimaging how these cards can look.

But of all, eco-friendly cards might soon become the most common denominator. A study across ten countries by Dentsu in 2020 found that ~87% of the customers today expect their banks to offer eco-friendly cards. Interestingly, the same article mentions that ~3/4th of all millennials would be willing to pay additional fees for a “green card”. Even the big issuers realize this.

Mastercard has entered into a Greener Payments Partnership (GPP) with 60+ financial institutions to limit the use of single-use plastics and to instead issue cards that are made from recyclable, bio-sourced, chlorine-free, degradable, and ocean plastics. Knowing that more than 6 billion cards are issued every year, this is likely to significantly reduce carbon footprint.

This has an obvious implication for even the most cold-hard capitalists: if you want to capture the customers of tomorrow, focus on making your physical products eco-friendly.

Final Few Thoughts

The objective of covering this topic was to one, emphasise the extent to which consumers are making eco-conscious choices, and two, to highlight the crucial role of payments companies in the process. With the purchases turning less impulsive and more purpose-driven, there is a need for such companies to move away from acting as facilitators to acting as enablers.

Consumer spending data can be leveraged to track carbon emissions, and to reward customers basis their behaviour. The tracking part is likely to become commoditized going ahead. The bigger opportunity to differentiate lies in building creative carbon offset and donation programs, such as offering carbon credits to plant trees or donating for research. Lastly, where loyalty is concerned, there is potential to issue cards that are “green”, along with all the personalization that we add today.

My guess is that within this decade, payments companies and products by banks will increasingly target not only operational net zero emissions but also enable their customers to become carbon neutral. If anything, this can fundamentally shift how companies and individuals approach their actions towards limiting climate change.

This is a subject that Indian companies and consumers have done less towards, and innovation beckons. If you have any interesting ideas on how payment companies can approach this, feel free to share those in the comments or send them over on LinkedIn or Twitter.

Other interesting reads on the topic:

On how sustainable innovation is changing the rules in payments by IDEMIA

On how Doconomy enables sustainable payments by Doconomy

Covid-19 Resources

Below is a list of some extensive COVID resources that I and people around me have found of use till now:

India Covid Resources offers pan-India crowdsourced COVID resources

Covid SOS curates the essential resources from the most helpful/verified posts

Covid Meals for India provides free meals for anyone who’s struggling with COVID.

Sprinklr’s dashboard offers curated list of tweets that highlight availability of beds, oxygen, and more

If you anyway needed a reason to donate, Diwakar has curated a list of some awesome people who are willing to share their expertise with you if you donate.

Lastly, this is another reminder to maintain safe distance, wear masks, travel only when necessary, and to help others in need. It is not only about you but also about the more vulnerable in your environment. Stay safe and keep others safe!

If you have any views or feedback to share, feel free to add a response below or to share your thoughts with me over Linkedin. In case you feel your friends or family would be interested in reading about fintech or economics, feel free to share the blog with them as well. See you in a week or two!