Credit Cards: The Calm Before the Storm? (#54)

Credit cards market stays bullish on issuance and spends, while regulatory clouds hover above

Welcome to the 54th issue of Unit Economics. Before you go reading, let me first draw your attention to our recently announced seed fundraise of $10Mn from 3one4capital, Venture Highway, and an array of esteemed investors. If you find the idea and the team at CheQ exciting, write to me on prince@cheq.one to begin a conversation :)

In the spirit of what we are building - for today’s article, I share some thoughts on the evolving credit cards space in India, focusing particularly on the regulatory and issuer trends of note. Some of these lend directly from the last discussion on RBI’s regulations. Dive in!

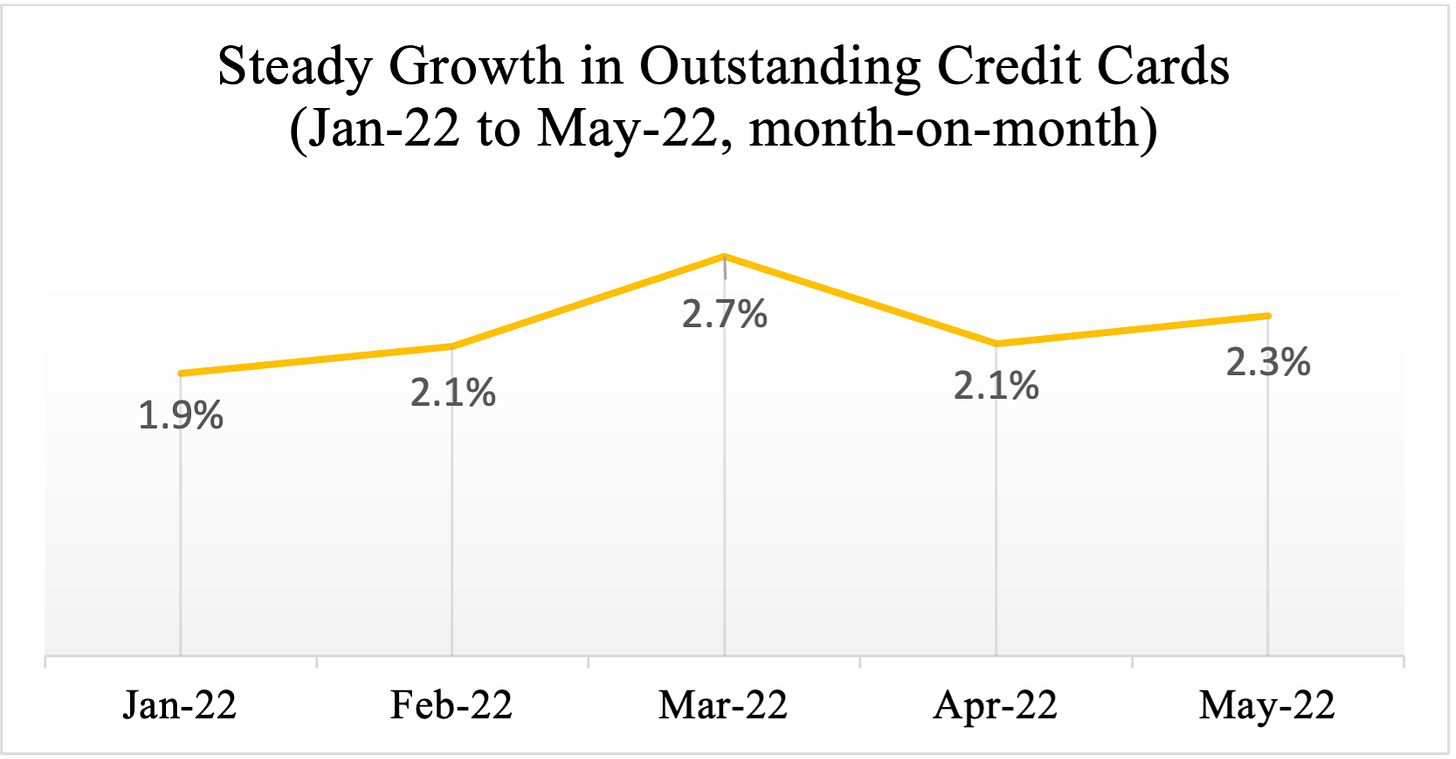

The market trends make this a good time to revisit credit cards. Take RBI’s bank-wise data for cards, for instance.

The numbers suggest a calm and steady growth in card issuance. But underneath, the issuers are fighting mixed battles.

The largest credit card issuer in India, HDFC Bank, is gradually gaining back the lost market share in credit card spends, making up ~27% of all spends in May-22, down from 31% before the RBI sanctions. The ten months of non-issuance also eroded the bank’s market share in overall outstanding cards by a few percentage points, which it wants to quickly overcome through new product launches and tie-ups. Further, to manage the cards’ P&L better, the bank has aggressively cut down its rewards on premium cards and weeded out inactive customers.

SBI and ICICI banks, on the other hand, have benefited from HDFC’s embargo, gaining market share in spends by 1 and 4 percentage points, respectively. ICICI Bank, particularly, has ramped up on its credit card portfolio – seeing a doubling of credit card spends on a YoY basis on the back of better digital onboarding, growth in discretionary spending, and a higher focus on commercial cards.

Axis Bank has been the biggest beneficiary over the last few quarters in market share, issuing more than a million credit cards in the March quarter itself. With the acquisition of Citibank’s Indian consumer business, Axis will move closer to its aim of becoming the 3rd largest issuer in the country and hope to achieve a 20% market share in the medium term.

RBL Bank, the 5th largest credit card issuer, has an enviable 5% market share. But the inordinately high exposure of credit cards on its balance sheet is forcing the bank to slow down and reevaluate its credit card strategy, drawing much frustration for Bajaj - its biggest co-brand partner.

The news around top issuers tells the tale of a brewing dogfight for market share, and a market disrupted with embargoes, acquisitions, and some introspection. The underlying theme appears, however, to be optimistic for the industry with the banks directing great focus on higher credit card issuance and spends.

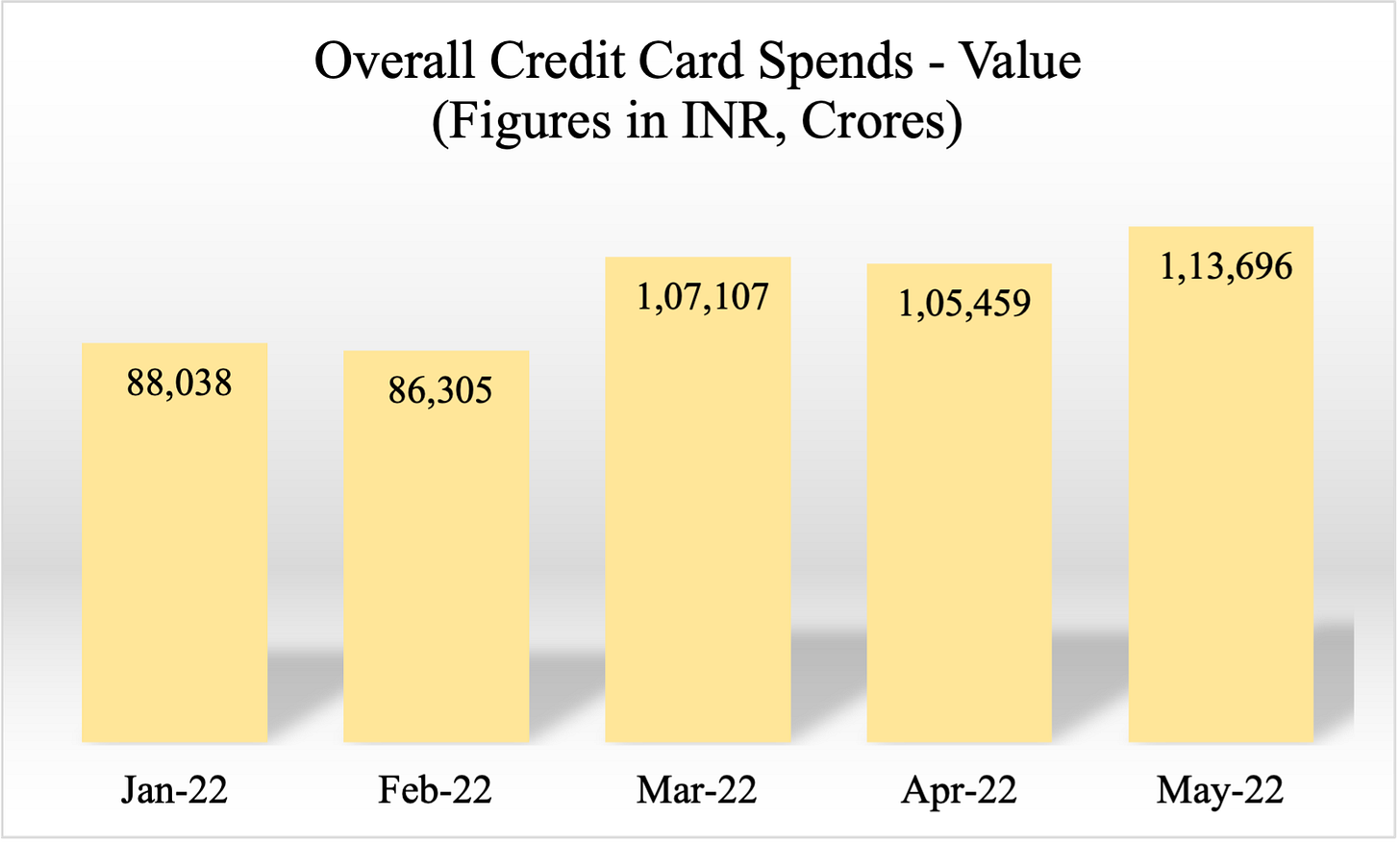

The consumers give other reasons for issuers to be bullish. For instance, credit card spends traded above ₹1 lakh cr. monthly in March-22 and had steadily moved up to ₹1.1 lakh cr. by May-22.

Cumulatively, the spends in FY 21-22 amounted to ₹9.72 lakh cr., significantly higher than the ₹7.3 lakh cr. (FY 19-20) figure in the pre-covid year. The average ticket size, too, appears to have gone up to ₹4,800, indicating an increased affinity for big-ticket or discretionary spends.

These trends give a sense of where credit card issuance and spends are heading, and the news is largely positive. But they do not account for the clouds of uncertainty that certain regulations bring for the next few quarters, each of which will have a noticeable impact on the credit cards market.

Race Against Time for Card Tokenisation

Of all regulations, the one for tokenisation casts the largest shadow on the card industry. With the merchants and PA/PGs unable to save card details, the online payments using the card and the payouts for credit to the card (for refunds, repayments, etc.) will see a sharp drop in customer experience, which can potentially migrate many to an alternate payment system.

Importantly, the timeline of implementation of the guideline will dictate the degree of impact on customers. If the RBI continues to maintain the 30-Sept mandate, the readiness of networks, issuers, and the adoption of solutions with the merchants is likely going to be sub-standard, which will force a steeper drop in experience and higher portfolio migration.

Comparatively, if the deadline is extended by 6-12 months, the industry participants can make the switch more seamless for the customers as a higher % of merchants are onboarded by PA/PGs and the coverage increases for payouts to cards via issuer and network tokens. If the extension is allowed, the migration impact on card portfolios should be relatively limited.

Hammer on credit-backed PPIs helps credit cards

The Reserve Bank of India’s stance on limiting the loading of PPIs with credit helps credit card issuers (1) by limiting the issuance and/or operations of existing credit-backed PPIs (Uni, Slice, etc.)., and (2) by making credit card issuers a more attractive target for companies looking to issue cards.

The expected white paper on digital lending, and the definition of full-KYC PPIs, among extensions and clarifications on other PPI guidelines, will give more clarity on the future of credit-issuance via PPIs. But until then, credit cards find themselves with an opportunity to barge further ahead with aggressive fintech partnerships and direct customer acquisitions.

Interoperability of Credit Cards with UPI

NPCI’s push to link Rupay credit cards with UPI seems well underway, but to many on the other side – the proposal to link credit cards with UPI invokes more questions than it answers at the moment.

How will card networks be involved in any stage of the transaction or fund flow? Will they be involved at all?

What will be the MDR for transactions processed over UPI from the credit line available on the cards? Will the MDR remain zero? Will the rate differ for smaller and larger merchants?

Will person-to-person transactions be allowed for credit cards over UPI?

Will the issuers be mandated to link all their card bins over UPI?

Will such transactions be accounted as credit card spends, UPI spends, or both?

These, and many other, questions can all have long and engaging discussions. But right now, the uncertainty makes it challenging to estimate how the regulation may impact the different credit card participants: issuers, acquirers, aggregators, networks, and others involved in the middle. It does, however, bring more to the table for the consumers, who will have another usage for their cards. This will, without doubt, act as an engagement lever and help increase the monthly spends on an average card.

Further, this may – for some years - remain the sole method for customers to combine a credit line and the convenience of UPI, which should push higher customer acquisition for virtual and physical credit cards.

Due Rationalisation of Charges

While the topic is partly touched on in the note above, the RBI’s vision for performing “a comprehensive review of all aspects related to charges involved in various channels of digital payments” brings another area of ambiguity for market participants, especially for any non-POS credit card transactions. The issuers and acquirers may also fear a cap being put on credit card MDR, along with rationalisation of some other charges that have long been raised as concerns by merchant associations.

Final few words

The present trends all draw a positive eye for the future of credit cards as a payment instrument, but the uncertainty of regulations puts a cloud over the head. Given the consequences of some of the guidelines, it should be obvious that the regulations need careful balancing of (A) being customer-centric and (B) maintaining the market optimism for issuers, networks, and other participants.

The next twelve months, more than most, will be critical for setting the direction for the credit card industry. We will – no doubt - continue to keep an eye out, and discuss many other developments to come in the space in the months to come.

If you have any views or feedback to share on the topic, feel free to add a response below or to share your thoughts with me over Linkedin. In case you feel your friends or family would be interested in reading about payments, feel free to share the blog with them as well. See you in a couple of weeks!

Credit Cards acquisition is greatly benefitted by the fact that most of the border lines defaulters are weeded out during covid times and only good bureau customers are available in market, which Banks are targeting now. Second, major correction is on credit card issuers way, with new RBI guidelines to cancel cards with NiL activity in last 12 months and non-active cards within 30 days of issuances.