Digital Lending: More than a feature for Payments (#38)

Industry-wide shift to lending, payments as an underwriting tool, and the future expectations

Welcome to the 38th issue of the Unit Economics. Today, I discuss why lending makes sense for payments companies, and how top Indian payments co’s such as Paytm, Mobikwik, BharatPe and others are thinking about credit. Dive in!

Payments companies are in the business of distribution. Their unit economics depend so heavily on scale that growth in volumes is as much a necessity for survival as it is for hygiene.

We know that low margins on transactions is one reason. Costs of marketing and promotions, including on discounts, cash backs, and of processing do not help either. But the economics gets increasingly complicated in an environment where access to money is not particularly scarce. With easier access, acquisition becomes a game of enticing customers with continuous offers. This is because when everyone sells candies, you need to keep offering more to keep your customers in the store.

As a result, the costs and the dependence on scale push payments companies to rely on a flywheel of acquiring users and/or merchants through certain use cases and payment instruments, which gets reinforced as your network participants demand more use cases and payment instruments. But these dynamics do not always solve for low margins, and often force companies to explore cross-selling other services to those in the network.

The good parts from payments, however, remain: (1) the focus on distribution helps the product gain scale faster, (2) the high-frequency use cases improve brand recall, and (3) the transaction and alternate data allow for more accurate user profiling.

But where do the payments companies find better margins?

Enter: Digital Lending

Lending offers roughly 2-5X the margins that the average payments revenue sources do, primarily through interest income, servicing fees, and other forms of late penalties. But with such rewards, the segment operates on a higher risk coordinate as well.

This makes the lending and payments inter-play just that much more challenging. While payments focuses on distribution, lending must maintain sanity on collections. Especially at a high scale, the losses from defaults can accumulate faster than we would imagine. The hope, however, is that if done right, lending can fill the gaps in the income statement.

So, what makes payments companies confident that they can lend well? For one, the nature of such companies is to seek opportunities that offer a chance of sustenance. And digital lending does give promises. More importantly but, payments is a great ally of collections.

Let me elaborate.

The traditional determinants of credit-worthiness rely on access to previous credit repayment behaviour of customers. This, while continuing today, excludes a significant portion of the population – especially in developing countries.

Now, with payments, the companies not only build a large network of merchants and customers, but they also capture the spending patterns of their users at high frequency. At first thought, it might seem a little abstract. But the spending patterns can include detailed insights into the category of purchases, location-specific activity, payments instrument preferences, early or delayed payments of bills, financial history through SMS dumps, and even tax-related activity. And this list is non-exhaustive.

For a payments company that intends to lend and offers multiple payments use cases, these data points are sufficient alternatives to underwrite. And dare I say, more reliable than traditional methods. This is particularly accurate of the merchant-specific payments distributors such as Square, BharatPe, Paytm, Razorpay, who get a consistent view of the merchant’s accounts (as merchants multi-home less). The sales and payments information can then be used to process instant loans or allow merchants to convert spends into EMIs at the point of purchase itself.

Similarly, for non-merchant payments applications, the customer transaction data allows companies to write new-to-credit underwriting policies. The policies then aid in offering purchase financing alternatives through BNPL, credit cards, or different sizes and tenures of personal loans. Perhaps we can also hypothesise that the frequent usage of payments applications likely pushes greater accountability in user’s psyche when accessing credit on the same platform, and reduces the possibility of defaults.

Additionally, the control over the credit underwriting gives payments companies the ability to measure and iterate their credit models with greater agility based on repayment results. With time, the models adjust to better assess the user base they evaluate, promising a healthier collections cycle.

I expect that you would find these arguments a tad optimistic. So, it would help to validate them by understanding the stance on lending of some of the more prominent payments companies in India. I have highlighted few such cases below.

Paytm

With a network of over 333 Mn users and 21 Mn merchants, Paytm mentions that it focuses on “providing micro-credit access to unserved, underserved and new-to-credit users”. It does so by offering three credit products to the consumers through the Paytm application: Paytm Postpaid (BNPL), personal loans, and credit cards – and is rapidly expanding alternatives for credit. Additionally, it offers a merchant cash advance facility on the Paytm for Business App, with a digital flow that allows for instant disbursal.

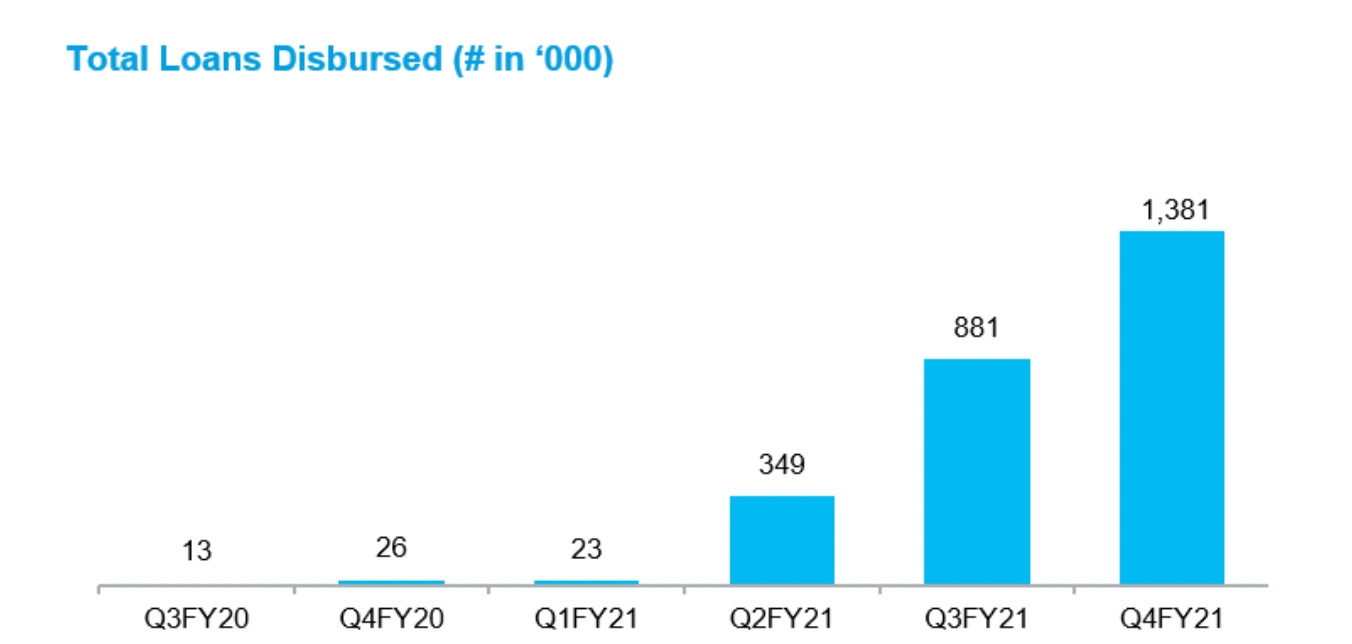

In the company’s prospectus, Paytm further highlights that “products such as merchant lending, …offered through our ecosystem, allow us to monetize our merchants, at little or no incremental cost of acquisition, and at attractive economics”, and gives us a good view of the aggregate loan disbursals across the Paytm ecosystem.

Going ahead, given the Nov ’20 RBI guidelines on payments banks, Paytm must also be keen to apply for the Small Finance Bank (SFB) license and begin lending in a more traditional sense.

MobiKwik

Another soon-to-IPO payments giant, MobiKwik mentions lending over 100 times and BNPL over 230 times in its prospectus, and underlines increasing “the usage of BNPL in India leveraging machine learning and lending partners” as one of the four pillars of its long-term business strategy.

Deliberating further, the company expects BNPL to reach a user base of 80-100 Mn in the country by 2026, higher than that of credit cards, and stresses the potential of BNPL over credit cards “on account of being digital, resulting in low cost of operations, as well as, having the ability to offer smaller ticket size credit, making it a more scalable and profitable alternative over the traditional credit delivery models”.

MobiKwik, over the last two years, has disbursed credit of ~INR 7,800 Mn ($106 Mn), and the tone in the prospectus makes it quite clear that the company expects credit, primarily through BNPL (Zip), to play an important role in its future growth.

BharatPe

BharatPe, only a little more than three years old, holds the envy of all others after receiving an in-principle approval to set up a Small Finance Bank (SFB). The company initially focused on distributing interoperable QRs to small businesses in Jun ‘18, with the low acceptance costs and interoperability as the value propositions. Since, it has onboarded over six million merchants and gained a valuation of ~$3 Bn.

But few would call it a payments company today. As early as 2018, BharatPe partnered with NBFCs to offer merchant loans on its platform. And only a few months later, it allowed merchants to invest through P2P loans that promised a return of up to 12%. The interesting bit, however, for our purpose is that its underwriting model, which uses merchant payments data, allowed the company to gain a high repayment rate of ~96%.

In the few years since it forayed into lending, BharatPe has

Become one of the largest POS players in the market with BharatSwipe, and rolled out Distributor-to-Retailer (D2R) finance, providing loans to distributors, wholesalers, traders, and dealers. It also plans to offer collateral-free loans up to INR 50 Lakhs for 7-30 days in the D2R segment.

Entered consumer P2P lending space, with the launch of 12% Club, which will allow individuals to invest their money and earn up to 12% in interest income. The investment is made on a platform-wide basis and does not expose individuals to merchant-specific counter-party risk.

Formed plans to build a loan book on the consumer side starting next month with the launch of PostPe. PostPe would be a BNPL product that will allow non-merchant customers to convert purchases into EMIs.

As a result of all the above initiatives, BharatPe has built a sizeable lending business on top of payments - with disbursements of ~INR 16,000 Mn in FY21 itself. Few would call lending only a feature in BharatPe books. Moreover, in the next couple of years, we can expect the company to grow the consumer-side loans extensively as it operates with the SFB license, and as PostPe, 12% Club gather momentum.

Razorpay

Razorpay, with an SME base of over 5 million merchants, has also adopted a merchant-lending focus with Razorpay Capital. Presently, the product offers merchants and corporates:

Instant settlements for digital payments, with the sales settlements processed on-demand and multiple times within the same day

Working capital loans through the merchant dashboard in minutes based on alternate credit decisioning system developed by Razorpay, leveraging both credit score and payments data

Cash advances up to certain approved limits, which can be repaid automatically to Razorpay through a share of the settled revenue, and

Corporate credit cards that allow companies to pay for marketing, travel, and other corporate expenses on a 50-day interest free credit facility and allows an ability to carefully budget expenses

By the end of FY22, Razorpay has set itself lofty ambitions of disbursing INR 8,000-10,000 Mn ($108-136 Mn) merchants loans monthly, highlighting its increased focus on lending. This would give it an annual rate of more than $1.5 Bn in loan disbursals, and the pace of migration to digital payments is likely to keep the growth high for merchant acquisition as well.

Presently, however, the company only acts as a conduit between NBFCs and merchants and is yet to acquire a lending license. With a proprietary loan underwriting system that trains on high loan volumes, there is every chance that a license will likely make the lending-based revenues an increasing proportion of the company’s income.

CRED

On what started as a simple credit card bill payment product, CRED has – much like others – ventured into lending to monetise its large user network. Impressively, the company launched CRED Stash last year to offer a low-interest instant credit line for its creditworthy customers and claims to have already processed loans worth INR 24,150 Mn (~$328 Mn), incurring only 1% NPAs (!).

In addition to direct loans, CRED has recently – and quite popularly – launched Mint, a P2P investment platform that would allow users to earn up to 9% in interest income, while loans are disbursed at 12-14% on the platform. With a default rate of around 1%, the company should be matching the loans and investments on the platform to make up to ~200-400 basis points on the interest differential, which would be quite significant given the limited marginal acquisition costs that the platform would have now with a 7.5 Mn+ strong user base.

The above list only signals the industry direction. And there are many others such as Pine Labs (which offers BNPL and working capital merchant loans) and PayU (which offers BNPL through LazyPay and EMI financing), who are building credit on the back of large payments distribution and proprietary credit underwriting.

So, what does all this mean?

The commentary on payments companies points to an obvious industry-wide shift towards lending for monetisation. And for the likes of BharatPe, CRED – the business foundations stand as strongly on lending as they would on payments.

Also note that monetisation aside, payments potentially emerges as a reliable tool for underwriting and building distribution. This, I believe, should lead payments companies to increasingly offer Underwriting-as-a-Service (UaaS) to lending partners and others in Fintech. Especially as the Account Aggregator framework gains sophistication over the next few years, one can expect Open Banking to evolve wider into an Open Fintech system and allow consent-based sharing of user data from one company to another.

On a three-to-five year horizon, this lending-focus should lead to some exciting developments: more Small Finance Bank and NBFC licenses for payments companies, higher underwriting standards with alternative credit models, outsourcing of the payments data for underwriting, pricing pressure on loans, savings, and P2P investment rates, and inclusion of a large but formally excluded population into credit.

All the above trends would require a sophisticated distribution and data network of payments, overlaid with strong lending fundamentals. And with this in mind, looking at lending as only a feature hardly makes product sense.

If you have any thoughts on the topic, write back to me on Linkedin or drop a comment below. In case you feel your friends or family would be interested in reading about payments, feel free to share the blog with them as well. See you in a couple of weeks!

As you mentioned,

Existing customer base (from Payments), Alternate Data (for UW and pricing), High engagement (more facetime for X-sell) all helps Payment FinTechs do Lending.

Some challenges (from personal experience):

1. Ensure the experience is truly digital and instant (not just pass on to traditional lenders);

2. Have patience and respect for Credit Risk (difficult for aggressive Product + Marketing + Tech startups to gulp)