Research: What led to the Indian Economic Slowdown (#1)

Research on twenty stressed sectors highlights five areas of focus for the Indian policymakers

Credits: Prashanth Vishwanathan/Bloomberg via Getty Images

It seems a long ago now when the world was talking about anything other than the pandemic. But before this, there still existed a chaotic world. And India specifically was walking a tightrope. Socio-political issues and an economy in free-fall were constant prime-time news.

Fascinated by the economic slowdown, Rishika and I in our last few months at IIM-Ahmedabad took up the project with the objective of studying the situation. The GDP numbers coming in lately had been depressingly low and many, much more proficient than us, had reflected on the reasons behind this. But the answers were still open for debate. We figured that with every piece of the economy showing signs of stress, the starting point of the research assumed great importance. Wherever we would set foot, there was a likelihood of finding ruins of importance. And this would only act as fodder to some confirmation bias.

Methodology: Going top-down

Keeping the above points in mind, it felt appropriate to adopt a simple and yet seemingly comprehensive approach. Starting from the top, we collected quarterly sector-wise gross domestic product (GDP)* data for the last eight years, i.e. since 2011-2012, which now serves as the base year. Thereon, we benchmarked the short term growth rates for each sector (last two, three and four year rates) against the long term growth rate (last eight years) of sectors themselves. This helped us identify the sectors seeing a fall from their expected growth rates, allowing us to zero-in on some while rejecting the others — narrowing the field of analysis. Below is a table showcasing the data:

*as per Ministry of Statistics and Programme Implementation (MOSPIs) criteria for GDP calculation

Source: Central Statistics Office, India (CSO)

Green indicates a 10%+ positive deviation from the benchmark rate, yellow indicates a deviation within a band of 10% on either side of the benchmark growth, while red indicates a sign of stress with more than 10% negative deviation from the benchmark rate.

The focus naturally, based on the proportion contribution to GVA and on the extent of negative deviation from the benchmark rates data, shifted to the following heads:

Financial, Real Estate and Professional Services

Trade, Hotel, Transport and Communication

Manufacturing

Mining and Quarrying

As we broke-down the sectors further in search for the root causes, we saw significant inter-linkages between ‘financial, real estate and professional services’ and ‘manufacturing’. The financial services sector, understood in part through aggregate bank deposits and credit, stood in a particularly terrible shape. This is quite plainly shown through the trends in credit deployment growth rates.

Source: Reserve Bank of India (RBI)

Over the last five years, growth in credit deployment has been rapidly declining from 0.49% in 2014 to 0.13% in 2019. The steep fall signalled this as an issue more structural in nature. Looking at the sector-wise numbers for credit deployment, it became even more evident that the cracks had spread to most, if not all, industries. To back up the claim, the table below highlights the sector-wise credit deployment growth rates:

Source: Reserve Bank of India (RBI)

Red indicates a significant fall from both the seven and ten-year benchmarks for the sector, while gold/yellow indicates a middling growth in credit deployment and one that is within an acceptable range of the benchmark numbers.

While we omit sectors and sub-sectors in the above table that were either too small in magnitude or showed numbers of little interest, the majority of the sectors have been included. This shows the extent of trembling of the credit sector felt on the economy. And although the above table gave us substantial room for investigation, we also researched in-depth on Real Estate, Railways, Road Transport, Broadcasting & Communication, and Mining & Quarrying to not leave any areas of note out of our purview.

Overall, we identified and studied twenty stressed-sectors through industry reports, through news articles on industry associations, and through industry-specific data from trusted sources such as Reserve Bank of India (RBI), Ministry of Statistics and Programme Implementation (MOSPI), Central Statistics Office (CSO), Centre for Monitoring Indian Economy (CMIE), Society of Indian Automobile Manufacturers (SIAM) and likewise to underline the despairing themes that eclipsed several industries. We present our results below.

Results: The five major problem areas

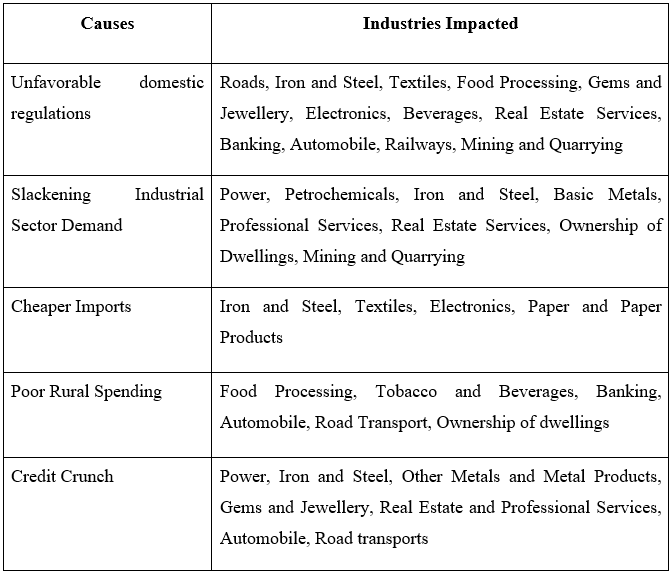

The five broad agents of slowdown, manifesting themselves in different ways across sectors, were hard to miss after a detailed and methodical analysis of the twenty sectors. We highlight the factors below, in no particular order, and mention the various ways in which they presented themselves in different industries:

Unfavourable domestic regulations: high GST rates, delay in GST refunds, ban on iron ores and mining shutdowns, delays in land approvals and arbitration process, drug price controls, ban on export of gold items, rationalisation of coal linkages;

Slackening demand from industrial sector: falling industrial and construction order sizes, supply overhang, clients restructuring favourable contracts for themselves, decline in production of bauxite, copper and chromite;

Adverse impact of cheaper imports: dumping due to global overcapacity, competition in cotton textiles, raw material cost in foreign country less than 50% of domestic, cheap Chinese electronics component suppliers;

Poor rural spending: lower savings and investments of consumers, lower credit deployment for food processors, delay in automobile purchases;

Credit Crunch: high debt servicing costs due to rising interests, high leverage levels, poor purchasing power of power companies, liquidity crunch in Gems and Jewellery, developer defaults and bankruptcies, high contribution of NBFC financing to two-wheeler industry;

Moreover, the table below attempts to neatly highlight the sectors that have faced serious stress due to each of these factors:

Conclusion: How can this knowledge help?

While the situation the country finds itself in is much more dire than the one the traditional economic slowdown presented, researching twenty stressed sectors and identifying the five largely responsible factors — poor domestic regulations, falling industrial demand, unfavourable import agreements or rather non-competitive domestic players, poor rural spending, and the credit crunch — certainly gives us directions to focus our efforts on.

We highlight few suggestions based on such insights and the industries most likely to benefit from them:

(A) There appears a great need for reforms in domestic regulations on a sector to-sector basis, especially concerning the GST rationalisation and the simplification of on-ground approvals and arbitration processes.

Textiles

Food processing

Gems and jewellery

Electronics

Beverages and Tobacco

Automobiles

(B) Additionally, a proactive approach to counter distortions in price controls and in raw material prices would greatly alleviate the distress in certain essential industries.

Drugs and Pharmaceuticals

Automobiles

Petrochemicals

(C) Finally, while quotas or tariffs on imports do not seem ideal today, strengthening the non-competitive domestic players in the import-troubled industries would allow such domestic players to cope better when the trade channels are back in full force.

Iron and Steel

Textiles

Paper and Paper Products

Electronics

Feel free to leave your thoughts below. Thank you for reading!