The Fuss about Recurring Payments (#28)

Also: how merchants, FIs stand to benefit and views on RBI's mandate

Welcome to the 28th issue of Unit Economics. This week, I wrote on Recurring Payments, or what many faintly refer to as subscriptions or card-on-file payments. This is a simple yet powerful concept, and with the talk around RBI’s circulars on the recurring transactions – I fear it is also a topic quite misunderstood. Over the course of this write-up, I expand on how recurring payments work, why they matter for different stakeholders, and where RBI might be right or wrong. Let me dive straight in.

What are recurring payments?

Imagine a simple scenario - a merchant asks you to make monthly payments for their service or product that you wish to use for at least a few more months. You have two choices:

Wait for the payment reminder each month and then make the payment, or

Give a standing instruction to your bank to auto-deduct the amount at regular intervals

If you choose the latter, you have agreed to make recurring payments to the merchant. For you, the difference between the first and second option was simple: the second option reduced your effort.

This, in essence, is what recurring payments are to the masses. A lower-effort alternative.

Subconsciously, however, there are two other reasons why the second option makes more sense:

The amount paid each month does not change, and so you can trust the deductions from your account. This also implies that you are likely to be more circumspect if the amount is variable. For example, you are more comfortable with allowing recurring payments for Amazon Prime than for your electricity bill.

You feel safe knowing there is no pressure on you to remember to pay for the service or product. You have instead instructed a machine that you consider reliable to do that. So, there is greater convenience in both: not requiring to go through the payment process and no fear of missing the payment.

We internalize the benefits of convenience, standard payments, and reliability when making the subscription-or-not decision. And with that, you can see that the idea of recurring payments is not science – instead, it is almost human and intuitive. It is also an idea that is older than conventional wisdom suggests.

For decades, companies have put standing orders for their employee salaries. Millions have done that to make their mortgage repayments. Before that, we would make oral agreements with our local milkman or newspaper seller to make fixed monthly payments – only if could give standing instructions for those too.

This brings me to how recurring payments today are increasingly different from the decades gone by. You will notice that these payments today are more:

Customer-centric: not only are the businesses putting in standing orders for their employees or vendors, but it is the average folks like you and me, who do it for services related to food, news, health, and other everyday habits

Flexible: we can subscribe to services that cost as little as a penny or rupee with no additional charges & importantly with little effort, and to services that require recurring payments on a time horizon ranging from daily to yearly

Industry-agnostic: recurring payments today are not limited to bills or payments for chores – they have expanded to delivery, streaming, and all sorts of online subscriptions. Recount the services or products you subscribe to, for reference.

This is likely well-understand by most.

But, what has enabled this change? I thought a little about this, and ended up with two A’s:

Availability of smartphones, the internet, cards, and other digital payment options to millions have made it easier for consumers to choose from a variety of payment options that merchants offer, incl. recurring payments; for businesses, incl. even local small-scale services, the SaaS integration for setting up and accepting subscription services is a more comfortable alternative than the multiple forms and conversations that earlier times required

Awareness of the benefits of providing subscription services and the consequent changes in business models in multiple industries are equal contributors. The changes in the business model are also a result of the shift towards services and software, from product and hardware.

Combined, the two forces have provided support for the snowballing of subscription services across industries and countries.

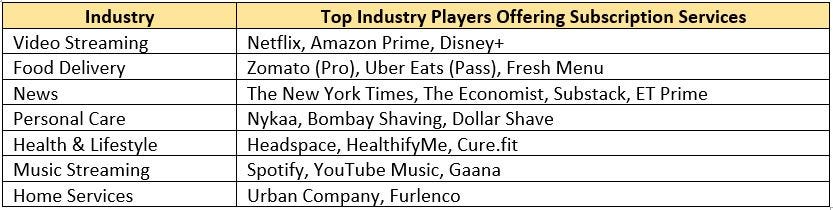

To drive the point better, below is a small exercise to look at the common subscription services across high consumption industries.

We notice that almost all of our regular needs – from food to streaming to home services - can be tied to subscriptions.

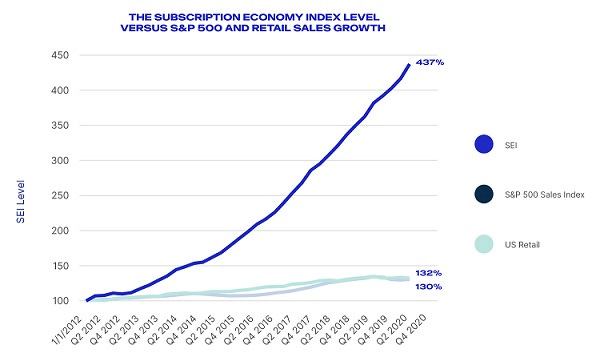

This is not, however, a recent phenomenon. The subscription economy for e-commerce has passed the introduction and already entered the growth stage. The Subscription Economy Index tracked over nine years by Zuora – a subscription-focused company – highlights the case with great aplomb.

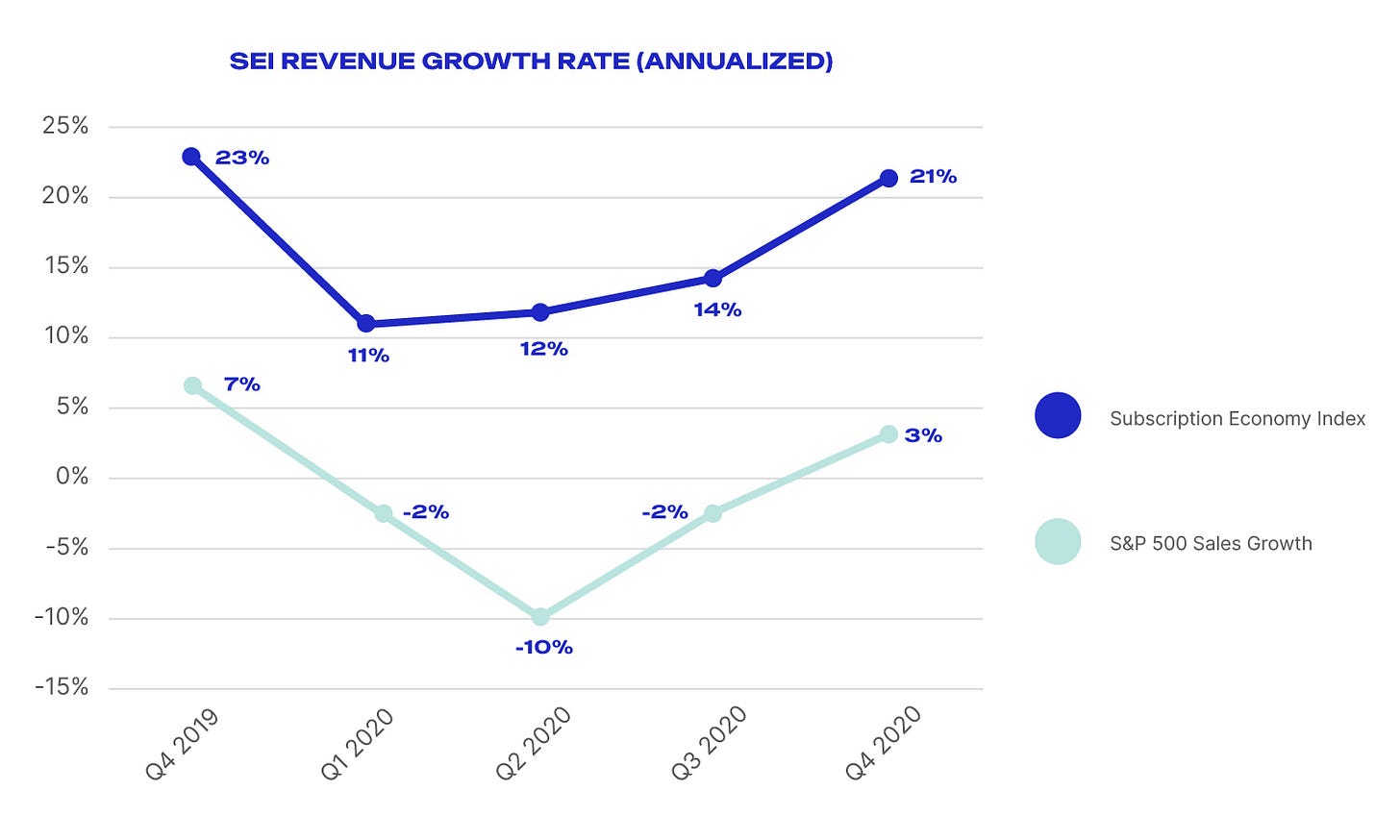

The graph shows that over the last nine years, sales for subscription businesses have grown ~5-8X faster than traditional businesses. We know that the prevalence of subscription services has made recurring payments common for the Gen-Z’s and the Millennials. The statistics also showcase that the subscription economy gathered 15-20 percentage points higher revenue growth during the pandemic than the companies under S&P 500.

Further, there is little doubt that the growth in e-commerce, which is expected to remain in double digits for the 20s, will continue to bring millions of more subscription businesses online and push the blue line farther away from the traditional economy.

Now that we have some background in how the recurring payments industry is shifting and growing, we can focus on the why surrounding the growth. We have already gone through the perspective of consumers, which centers around convenience. For the next part, the focus shifts to the merchants and the intermediaries.

How do merchants benefit from subscription services?

Even before we go to the benefits for merchants, note that payments is one part of the customer shopping experience. And today, we are moving towards a path where everything in the spectrum from selection to delivery is increasingly hassle-free.

What this implies is that even if subscriptions do not exactly add anything to the merchants, it offers a relatively improved experience to the customers and that enough can be a reason to switch.

But as it stands, merchants do see other, more exciting benefits of subscriptions. Below are the ones that are common across different subscription services:

Predictability of Revenues: Traditional brick and mortar stores or even online sellers on websites such as Amazon depend on ad-hoc purchases, which makes their revenues unpredictable. But for businesses that base their pricing strategy on subscriptions, revenue is more smoother and predictable. This model also acts as a tool for risk management, making operational planning and estimates of business health more accurate.

Lower Costs: the improved data capabilities through subscriptions allow the company to target and acquire users at lower cost, and the same is then translated into lower operations, marketing, and distribution costs.

Simpler Pricing: For a merchant that has multiple SKUs – take Netflix, or Spotify – a tiered or a single-price subscription model reduces the complexity that would come with setting individual prices for multiple products.

Customer Loyalty: perhaps the biggest, and most desired, the benefit of subscriptions is the growth in the number of loyal customers that merchants experience due to an effective customer lock-in, improving their retention metrics. This is crucial since empirically, only a 5% increase in retention can improve profits by ~25%. This is largely because the probability of selling to an existing customer is significantly higher than to a new customer, 60-70% vs. 5-20% respectively according to some metrics.

There is, of course, no certainty of success with a subscription model – and there are likely to be challenges of early acquisition, high churn rate, poor pricing, incompatibility with business, or billing management. But if executed well, the benefits seem obvious. Luckily for merchants, there are mature subscription service providers that can help troubleshoot most of these issues.

Implications for Financial Institutions

The shift towards the subscription economy has some equally surprising outcomes for financial institutions.

A survey by CitizenMe and Zuora, for instance, found that ~52% of UK consumers – traditionally sticky – would be enticed to switch banks if the bank subscription included an entertainment bundle. Interestingly, the survey also said that:

Consumers increasingly wanted personalized services on top of banking services, with 68% willing to pay a recurring fee to access them

Nearly 6 in 10 consumers were willing to share their transaction details in return for services that bundle their subscription payments and regular outings

Highlighting the trend, the report refers to the growing influence of younger digital banks, such as Revolut, that have introduced customers to the subscription model. The trend towards digital banks is global, and it would not take time for the traditional banks to come against similar challenges in other geographies as well.

This is not a losing battle, however. Financial institutions stand to accrue the same benefits that merchants would through subscriptions: improved customer experience, better loyalty, profitable customer relationships, and an analytics-driven ecosystem. For banks, a definite opportunity lies in recognizing how they can best offer subscription services to their customers.

As for financial institutions that act as intermediaries in the merchant-to-customer recurring payments, better visibility of the transactions from merchants should help make their transaction-related revenues more predictable. Moreover, the early recognition of subscription streams provides an opportunity for FIs to acquire users by looking at the new type of transactions the users are making.

Lastly, there is increasing frustration for consumers in handling the multiple subscriptions today. This provides a differentiating opportunity to provide subscription management features to customers through issuer card and bank account – potentially increasing the usage. It will especially become harder and harder to keep track of all of the services we pay for when our spending on digital subscriptions rises as more of our possessions become connected to the internet. For the financial institutions, the field is open.

Right, so now to the recent developments that made me dive deeper into the topic.

RBI’s Mandate on Recurring Payments

If you are not from India, the Reserve Bank of India (RBI) is the country’s Central Bank. And in the last two years, it has released three circulars (Aug 19, Jan 20, and Dec 20) mandating the issuers to fulfil certain authentication requirements for processing recurring transactions by 31st March 2021, which has since been extended to 30th Sept 2021. Here is a brief recap of the key guidelines from the earlier circulars and my take on them:

For recurring payments (not ‘one-time’) using cards, UPI, or Prepaid Payment Instruments, including wallets - issuers must ensure that cardholders have opted-in to the recurring facility (e-mandate) through a one-time registration process. Moreover, “An e-mandate on card for recurring transactions shall be registered only after successful Additional Factor of Authentication (AFA) validation”, i.e. additional step of verification to validate any information not visible on the cards from the user.

My Take: Given that the e-mandate registration is one-time and seemingly not repetitive for each merchant, it makes sense from a security standpoint to necessitate it at the time of card registration or to allow an option thereafter. But to do that for PPIs and UPI might seem unnecessary given the already existing KYC mandates on payment applications.

“While processing the first transaction in e-mandate based recurring transaction series, AFA validation shall be performed…. subsequent transactions may be performed without AFA”

My Take: Enforcing AFA validation for the first recurring transaction makes little sense, given the exhaustive nature of e-mandate + AFA validation that the issuer is required to perform at registration. More importantly, this introduces friction in the recurring payments process whose appeal arises from convenience – and discourages the uneducated users to rely on recurring for payments.

“..the issuer shall send a pre-transaction notification to the cardholder, at least 24 hours prior to the actual charge / debit to the card. While registering e-mandate on the card, the cardholder shall be given facility to choose a mode among available options (SMS, email, etc.) for receiving the pre-transaction notification from the issuer in a clear, unambiguous manner and in an understandable language.”

My Take: The pre-transaction notification is smart. There are recurring transactions that consumers would prefer to cancel, but forget to or are unable to. To be honest, merchants know and rely on a few such errors. With the notification, the consumers stand to become aware and act on any unintended recurring transactions – all while not introducing any friction to the payments process. The option to select the communication medium also provides sufficient flexibility to the consumers. Overall, I think it is a good move - central banks around the world should look into this as well. But I don’t think the merchants will see it the same way.

“On receipt of the pre-transaction notification, the cardholder shall have the facility to opt-out of that particular transaction or the e-mandate. Any such opt-out shall entail AFA validation by the issuer.”

My Take: Similar thoughts to the previous point. Smart and consumer-friendly move. The added facility to opt-out would be a relief to many who have found cancelling subscriptions challenging. In an ideal world, you would probably have the merchants send these notifications to the subscriber itself, but well!

“The cap / limit for e-mandate based recurring transactions without AFA will be ₹ 2,000/- per transaction (extended to ₹ 5,000/- per transaction thereon). Transactions above this cap shall be subject to AFA as hitherto.”

My Take: The AFA mandate on recurring transactions above ₹ 5,000 might seem reassuring to some, and needless to others. This requires users to put in extra effort for each such recurring transaction, but the good news is that there are hardly many subscription services charging above the 5K barrier per transaction in the country right now. So, it should impact a small segment of consumers at most.

“The issuer shall provide the cardholder an online facility to withdraw any e-mandate at any point of time following which no further recurring transactions shall be allowed for the withdrawn e-mandate. The withdrawal …shall entail AFA validation by the issuer”

My Take: This is again useful for users who wish to cancel their e-mandate. Clear communication and directions on the steps would help many that are likely to struggle with revisiting the entire process. The question, however, remains on when the issuers would communicate the same to the users. As for the AFA validation, the move would work similarly to a pop-up that opens when you are closing an unsaved file. Moreover, on cancellation, it should be easy enough for the Issuer to communicate the same to the merchant by blocking the card for further recurring transactions.

“An appropriate redress system shall be put in place by the issuer to facilitate the cardholder to lodge grievance/s. Card networks shall also put in place dispute resolution mechanism for resolving these disputes with clear Turn Around Time (TAT).”

My Take: A lot of grey areas here on what would constitute an “appropriate redress system” or a clear and acceptable “Turn Around Time (TAT)”. As for the card networks, the challenges in India have always been a handful – and this should be another in the long list. However, if the guidelines on redressal are well-defined, there is an opportunity to enforce a proactive approach for the large volumes of grievances that would come with the new laws.

Finally, “it shall be the responsibility of acquirers to ensure compliance by merchants on-boarded by them in respect of all aspects of these instructions.”

My Take: In the words of many banks, ensuring compliance of merchants on-boarded has been their biggest issue in following the circular. The merchants themselves have struggled with resources to enforce the conditions. There is no easy workaround for this. Unless RBI shifts the responsibility on merchants, which it is too late to do, the Issuers will have to work overtime to ensure that the systems are in place for merchants.

Final few thoughts

The subscription economy, progressing in the shadow of e-commerce, is still at the early stages. As the years go by, we are going to see more complicated & richer types of recurring transactions, and more sophisticated subscription service providers. With that in mind, the merchants and financial institutions must stay abreast of and adapt to the changing consumer preferences that are likely to guide the future.

At the same time, the regulators must – while focusing on security – not inhibit the developments through ill-timed friction in the payments processes. RBI’s additional factor authentication and other inputs that require regular consumer inputs are likely to go against the motives of merchants and must be implemented only when necessary. In essence, regulators must turn more issuer-friendly and be considerate & proactive in advancing as quickly as the recurring payments industry.

Other interesting reads on the topic:

On why businesses should consider subscription model by Shopify

On the guidelines for processing of e-mandate for recurring transactions by the RBI

On Banking on the subscription economy by Zuora

If you have any views or feedback to share, feel free to add a response below or to share your thoughts with me over Linkedin. In case you feel your friends or family would be interested in reading about fintech or economics, feel free to share the blog with them as well. See you in a week or two!