Tipping Point for Credit (#64)

Credit cards on UPI silently prepare to deliver a large shift in credit

Welcome to the 64th issue of Unit Economics. In this article, I share my conviction for credit cards on UPI, and talk about how we may be approaching a point of inflection for Credit in the country. Dive in!

This is not new. We have talked at length about UPI’s brilliance, remarked bullishly on credit on UPI, touched briefly on the prospect of credit cards on UPI, and wondered whether digital bank credit may be the answer.

The conversations have always stemmed from the high promise of combining access & need for credit with the convenience of & affinity for UPI. And the numbers justify the opportunity gap:

India’s private credit to GDP ratio of 55-60% is almost half of what is considered healthy, and significantly lower than the world average of ~150%,

The existing-to-credit customers seem to be getting more comfortable with credit, with high annual growth of >18% in outstanding retail loans, and a surge of >47% in credit card spending,

Meanwhile - UPI, nonchalantly, has seen volumes grow >60% annually, with a ~120% growth in the volume of P2M transactions

Going a level deeper...

The credit-to-GDP ratio suggests a problem of supply, with the lack of access and ability to assess creditworthiness by banks, NBFCs keeping credit inclusion at low levels. This reality of credit stands at crossroads with the advancements in the maturity and acceptance of digital payments.

However, the potential for credit remains tall, with the increase in outstanding debt and credit card spending signalling that credit, once accessible, can quickly take a higher wallet share of household spending. And as has stood true over time, access to credit can unlock an increment in the propensity for consumption in an otherwise savings-led psyche of Indian households.

The gaps in credit inclusion, despite the seeming potential for credit, give teeth to why the almost-ubiquitous UPI may bring about a new phase for access and spending on credit.

Notice that the above narrative has stood true for years. Yet, for credit on UPI, there has been little noise.

However, at this moment, certain undercurrents suggest that we may soon be at a tipping point. An early indicator of the headwinds is the developments in the credit cards on UPI space.

In Jun-22, the RBI opened gates for linking credit cards on UPI, announcing that the facility be reserved initially for RuPay credit cards

In Sept-22, the NPCI launched the facility via the BHIM app, announcing the banks that would go live on it

In Dec-22, Razorpay became the first PG to support the feature,

In the last few months, the likes of Paytm, Mobikwik, PhonePe, and Google Pay - the latest entrant – built the infrastructure to allow RuPay credit cards to be accessed for UPI transactions, and

This week, PhonePe claims to have linked >2 lakh RuPay credit cards on UPI already, cumulatively processing over ₹150 crores in the payment value

This is potentially a tangential shift in the usage of credit cards, which have predominately been associated with plastic & reserved for higher-value transactions. They would now be equally accessible for lower-ticket size transactions, say, at a Kirana shop. Almost immediately, this would allow credit cards to take up a larger share of customers’ wallets – with the added convenience of UPI, without requiring a switch in form factors.

Importantly, I believe this to be a landmark phase for Credit, and believe that the form factor of “credit card” is only relevant here due to the regulations allowing for the least grey for credit cards in its interpretation of “what form of credit can be allowed over UPI?”.

Take Kiwi, for example, which is expected to go live in the next couple of weeks. The platform will issue virtual RuPay credit cards to its registered customers and link these cards to Axis Bank issued UPI handles for transactions. For customers, the convenience of (a) getting the credit issued in minutes, and (b) being able to use it over UPI handles, is a significant leap in how they will use credit, replacing cash & savings-account-led-UPI with credit-on-UPI for everyday transactions. In all this, a credit line being issued via a credit card is hardly relevant, given the absence of plastic, and card points.

Paytm, similarly, has partnered with SBI to issue RuPay credit cards – and I expect them to follow a similar model. Others should follow suit soon.

I strongly believe that for closing the gaps in credit inclusion, the applications must resort to building a similar end-to-end loop within the same app for (a) issuance of credit, and (b) allowing the credit to be used for UPI.

For instance, the present-day flow of (a) credit card issuance at the bank level and (b) linking the same on separate UPI apps, limit the accessibility to the pool of customers who (1) have exposure to big banks, and (2) are willing to go through the friction-filled onboarding journeys of banks for availing cards, unless they already own one – which would be true for only a small pool given the low CC market share (3%) of RuPay.

For consumer UPI apps, issuing credit cards should be a long-term strategy, which will have initial hurdles of winning bank partnerships, certifications, and months of integrations with TSPs. Yet, once achieved, it can have undoubted business benefits of (a) enabling wider customer adoption of credit on UPI, (b) presenting monetizable opportunities via distribution fee or revenue-sharing agreements with partner banks, and (c) offering higher control of a customer’s behavior, by allowing card management on the same application.

My conviction here is strengthened due to what I saw at Jupiter. We launched something similar last year, called Jupiter Edge (or “Bullet” a while ago), wherein we would issue a credit line after performing a full-KYC based onboarding & and then allow the same to be utilized over UPI.

The customer was not promised any incentives of reward points, cashbacks, etc. – but only an interest-free credit-line that could be used over UPI. They already had access to credit lines and UPI functionality on digital apps, but none offered both together. We noticed that, immediately post launch, the numbers for daily acquisitions, funnel conversions, and the utilisation of available credit were incredible and significantly higher than the business estimates. The level of customer engagement signaled an almost immediate product-market-fit, much more than Jupiter had initially seen with its rather anticipated neo-banking app.

Further, our customer dipstick analysis suggested that the behavior seemed consistent across customers at different income levels & geographies, with most of them replacing their existing low-value spends with credit-on-UPI.

We thought we were onto something big, only for the regulations to put a pause. Since then, the regulations have come a full circle to land the industry into the same position, with whiter, greener fields to grow in.

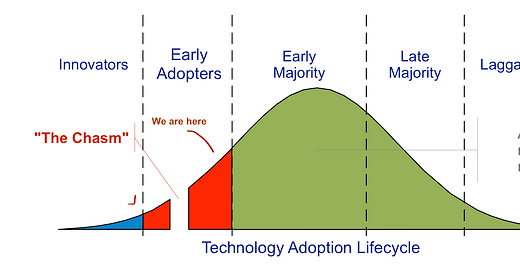

In the adoption lifecycle, credit-on-UPI I believe may already be placed beyond the chasm as it begins its journey – ready for hyper-growth and the transition into early majority within the next year.

We can be hopeful that, on the back of UPI, it takes Credit to a more mature state where the late majority would adopt it as comfortably.

What’s next for credit-on-UPI?

I expect credit cards on UPI to turn into a big battlefield within the next year, with multiple large apps partnering to issue credit cards & pushing the customers to leverage them for transactions over UPI. Placing some long-term bets, I ambitiously believe that the headwinds would lead the way for the following:

RuPay’s market share in credit cards would go from 3% to >10% (i.e., >12 mn cards) within the next couple of years, with total outstanding credit cards expected to reach >115 Mn by FY25 at current pace

While ~11.7 Mn credit cards were issued in FY23, few would have been issued in virtual-only form. I expect virtual-only credit cards, issued without plastic or metal, to make up >15% of all credit card issuance within the next two years. It may then make business sense to issue plastic at a premium to cover delivery costs.

Further, more than 40% of credit card originations of banks may come via partnerships with co-brands (~6-7 Mn credit cards annually) by FY25 – with the credit card on UPI expected to be pushed aggressively by fintech companies

With credit cards on UPI maturing and credit lines on UPI likely next in line – the underwriting for banks may also adjust to give a higher weightage to the alternative data points acquired via fintech applications on transactions, repayments, social behaviors, etc., as these would quickly become their source of acquiring a higher proportion of credit card customers.

I expect this to be a landmark phase for Credit in the country and will be excitedly keeping an eye out on the developments. Until next time!

If you have any views or feedback to share on the topic, feel free to add a response below or to share your thoughts with me over Linkedin. In case you feel your friends or family would be interested in reading about payments, feel free to share the blog with them as well. See you in a few weeks!