What do global payments reports have to say? (#41)

Understanding the trends from the McKinsey, BCG, and PwC payments reports

Welcome to the 41st issue of Unit Economics. It is the time of the year again when multiple consulting firms release their annual payments reports. I have had the chance to go through the ones from McKinsey & Co., BCG, and PwC over the last few days, and am using this blog as an opportunity to share a few thoughts on the views referenced within.

In doing so, I have tried to skip over the glossy sections and pick out areas that offer comments on subjects that appear most relevant. If you have any observations on any of the topics, feel free to share those with me. Let’s jump straight to the trends.

Strong expectations on Payments Revenues; Bullish on Asia-Pacific and Latin America

McKinsey and BCG expected the payments revenues to decline year-on-year in 2020, and their estimates of actual revenues corroborate that expectation. However, the magnitude of decline (-5% and -2.5%, respectively) was much lower than assumed. This is said to be on account of the strong e-commerce and non-cash payments migration, and the large monetary stimuli that helped increase consumption.

Further, both firms maintain views of positive global recovery and estimate the payments revenue to grow at ~7% annually for the next five years. Saying that, the definition of what constitutes revenues differs for the firms. For McKinsey, net interest income (NII) contributes ~46-51% to the payments revenues, while BCG and PwC only consider transactional parameters – interchange, scheme, and other processing fees. I would side with the latter here since NII is a core banking metric and does not directly concern payments.

Regardless, diving a little deeper into the numbers, all three reports build bullish cases for Asia-Pacific, followed by Latin America and developing regions of Africa. For Asia-Pacific, the revenue growth is expected to be led by,

Increased digitisation of B2B and cross-border payments, especially for SMEs,

A growing number of super-apps as payments platforms,

Alternate forms of payment methods, such as BNPL,

Growth of instant payments platforms such as Troy (Turkey), Mir (Russia), UPI (India), and NPP (Australia), and

Highly proactive Asian institutions, which 78% of respondents in PwC’s survey expect will move faster than the rest of the world

Lastly, with the high levels of private funding and the growing number of firms at each layer of the payments chain – mergers & acquisitions are expected to become the norm in Asia-Pacific and Latin America for the next few years. This should not be surprising given that the last couple of years have seen consolidation on both the issuer and acquirer sides in developed and developing countries alike.

Focus shifts to CBDCs; the popularity of Stablecoins forces progress

Digital currencies find lengthy mentions in all three reports, signalling an obvious shift from last year, when they were referenced in passing at their best. In the latest issues, the launch of the Sand dollar in the Bahamas and the large-scale pilot of the e-yuan appear the key inflection points. Further, the BIS surveys (wrote here) have been cited to showcase the growing central bank interest in CBDCs around the world – with “more than four-fifths of the world’s central banks… engaged in pilots or other central bank digital currency (CBDC) activities”.

The McKinsey report draws away from any definite opinions. Instead, it hypothesises that the progress on CBDCs is potentially driven by the staggering growth in volumes of private currency-backed stablecoins, especially for the likes of Tether and USDC.

The report further suggests the possibility of stablecoins and CBDCs coexisting in the future. Although CBDCs have stronger regulator support, the stablecoins have seen much wider adoption in the limited time – and as the BCG white paper mentions, Facebook’s Diem and JP Morgan’s JPM Coin will only add the pressure.

However, with the speculations around Tether, there remains limited proof of concept and utility for stablecoins and enough concerns on the practices of private participants to imagine the active coexistence of global stablecoins with government-issued currencies. If a stablecoin can prove reliable and stay away from such speculations for a good period, maybe the bridge can be crossed – but I don’t imagine this would happen for at least the next 2-3 years.

Additionally, all three reports throw caution to their views by reminding readers that the use of CBDCs “in day-to-day retail and wholesale transactions remains at an early phase, with a host of regulatory, security, and privacy issues yet to be resolved before adoption goes mainstream”.

While CBDCs and digital currencies find more mentions in the reports this time, the words from consulting experts surprisingly lack any insights on the topic that you would not get from the preliminary reading of the BIS surveys. My views on the topic remain strongly in support of retail CBDCs, however, which I expect would become one of the pivotal financial innovations of the decade given their potential for targeted monetary interventions, displacement of the costly cash usage, and likely quick adoption in a mobile-first world.

Real-time payments see high growth in adoption; Digital wallets emerge as the preferred option

Another common trend across the reports was the recognition of the growth in real-time payments systems. In a survey of banking, fintech, and payments organisations by PwC, 97% of the respondents expected to move towards a higher proportion of real-time payments. McKinsey’s report further cites ACI Worldwide, which estimated that the volumes of real-time payments (RTP) rose “by 41 percent in 2020 alone, often in support of contactless/wallets and e-commerce”.

This has been a growing trend over the last few years now, and the pandemic has only accelerated the shift. Today, more than 50 countries have active real-time payments rails, with the countries in Asia-Pacific - particularly India, China, South Korea, Brazil, Australia - delivering high volume growth. Additionally, there is room for further optimism with the likely development of the European Payments Initiative (EPI) and FedNow over the next couple of years – both of which will be built on real-time payments.

The graph below only validates the sentiment by highlighting how quickly instant payments are adopted for credit transfers post-launch.

While tackling an important topic, the reports again provide only a birds-eye view and share little on how instant payments are shifting behaviors or impacting payments business models.

They do, however, constantly mention the increasing usage of digital wallets as the choice of payment method for real-time payments – away from the cards or bank accounts. The Global Payments Report by WorldPay, which gives an extensive view of shifting behaviours in payment methods by channel and region, shares this vision and highlights that digital wallets accounted “for 44.5% of e-commerce transaction volume in 2020, up 6.5% from 2019”, with expectations that they will account “for 51.7% of e-commerce payment volumes by 2024 with slight declines in credit cards (to 20.8%) and debit cards”. And lastly, there is a passing mention of P2M and bill payments developing as prominent use cases for real-time payments. But if India’s experience is to go by, merchant payments are likely to see a similar frenzy for the likes of Pix and other new RTP systems.

Merchant acquirers feel the need to diversify; SMEs offer high growth opportunity

Banks earlier relied on payments acceptance as a reliable revenue source, but have over time had to deal with thinning margins on account of (1) regulations forcing lower MDRs, and (2) payments aggregators controlling a larger share of acquirer volumes.

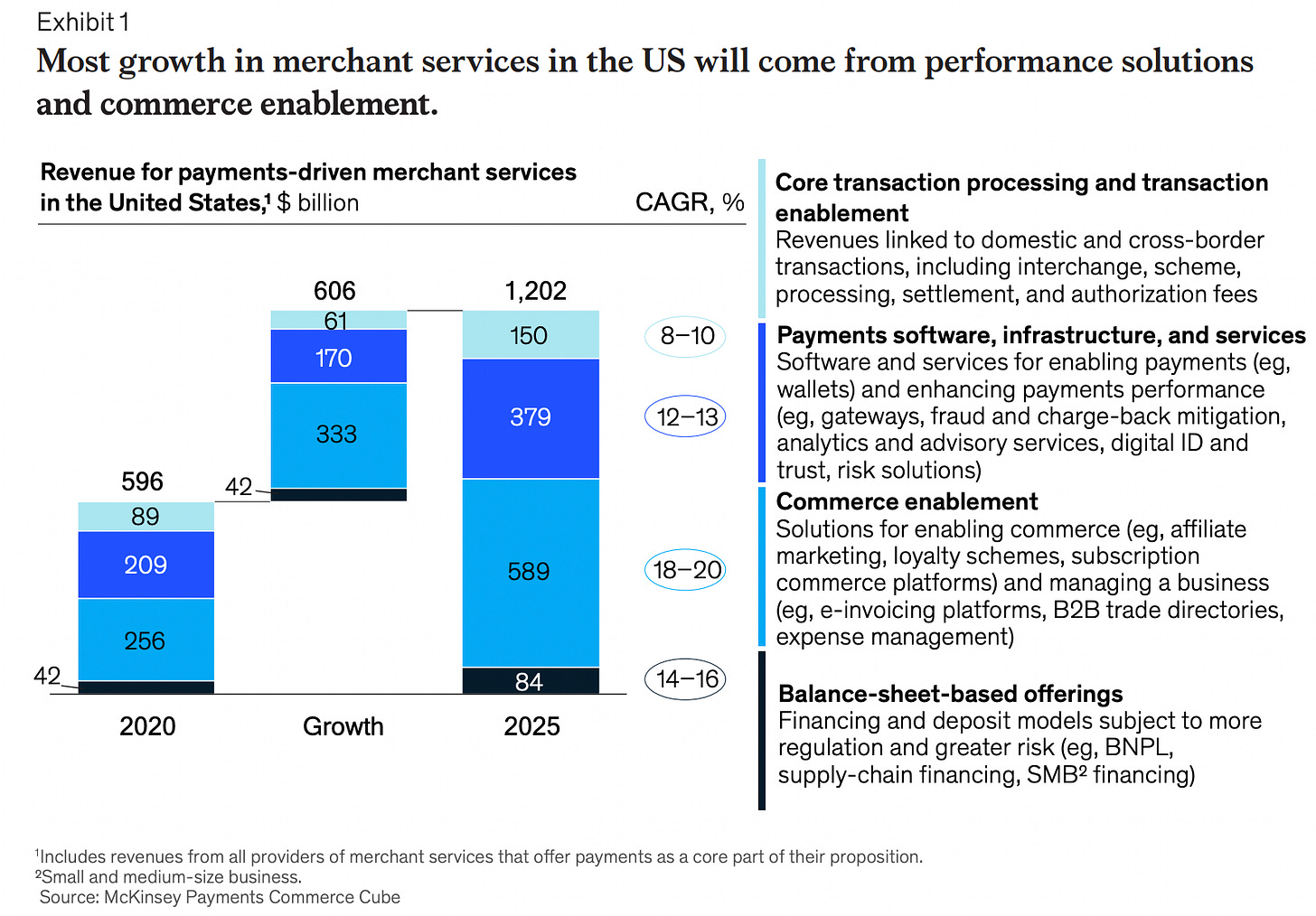

The McKinsey report dives deeper into the acquirer side and specifies the potential for earning premiums through the provision of enhanced reconciliation and multi-country processing support, working capital facility, and other merchant-specific value-added services. The research suggests that software services focused on commerce enablement and better payments performance are likely to account for ~80% of all merchant acquirer revenues over the next five years – with SMEs driving high adoption.

The BCG consultants are equally bullish on the acquirers, expecting an 11.3% CAGR in revenues through 2025. And the expectations are similarly poised on advanced value-added services for merchants, commerce enablement solutions (e.g. invoice and expense management), and access to financing options for new revenue streams.

Interestingly, McKinsey research estimates that payments acceptance alone is only ~10% of the potential share of merchants’ wallets that acquirers should target. Business management and POS software, financing, insurance, and payroll services are equally interesting opportunities. I have reservations on some of the numbers in the image below, but regardless – it offers food for thought on how little acquirers might have explored yet.

PwC and BCG reports do not go as granular, but they do share the optimism for banks and card processors to expand further into merchant services – and the reports relay more focus on fraud and risk mitigation as a service while doing so. Lastly, disintermediation on the acquirer side is briefly mentioned in all three papers, with vertical integration through acquisitions and direct access to merchants for e-commerce payments acceptance the main factors.

Similar views are drawn from observing the recent developments in India and the U.S., where the likes of Pine Labs, BharatPe, Stripe, and Square have aggressively acquired smaller companies to expand merchant services, launched soft POS and capital financing solutions, and even increased focus on B2C. There is, without doubt, a renewed interest in the merchant acquiring space over the last couple of years as the issuer side gets more crowded. And if anything, the focus on minimising the complexity of payments acceptance for merchants is likely to have a much larger impact on commerce than what we have seen from the innovation in issuers.

Financial crime needs more attention

Max Levchin once described PayPal as a security company pretending to be a financial services company, where PayPal was “in the business of judging the risk of each transaction and occasionally taking the risk on”. This analogy is accurate for almost all payments companies that today constantly deal with more advanced financial crimes.

Given this context, there is surprisingly little mention of fraud and other payments risks in the McKinsey and BCG reports – especially at a time when online payments are at their most vulnerable with millions of digital-first merchants little aware of the risks. It comes as no surprise then that in one of PwC’s surveys, security, compliance, and data security risks are the top concerns for banks and fintech companies, well ahead of CBDCs or other expected disruptions.

With risks of synthetic identity frauds, a proliferation of payments processors, and the rise of private cryptocurrencies, the need for ensuring proper fraud and risk rules has never been higher for payments. A report by Sift, estimated the increase in the average value of attempted fraudulent purchases by ~70% YoY in 2020, much higher than the growth in e-commerce or digital payments. This migration to online will continue for consumers and businesses. And so will the attempts by fraudsters.

Not every merchant or payments processor, however, will have the required capabilities to combat such risks. This, as also highlighted by the PwC report, allows specialist fraud-as-a-service providers to gain ground. While I do not have strong views on the topic, there should be more discussions around fraud, and investments into the space given the above trends.

Final few thoughts

The reports cover a diverse list of payments trends but surprisingly offer few actionable insights on most bits. If you are an operator in the space, I would still suggest covering the merchant acquiring section in the McKinsey report and skimming through the insights from PwC here. For a more granular understanding of the acquiring or issuer space, however, the quarterly and annual reports from Mastercard, Marqeta, Afterpay, and the likes, and the reports from Glenbrook and Worldpay seem to offer the most value for time.

As for the trends themselves, the focus on merchant acquiring and digital currencies seems appropriate, but the lack of discussion on fraud, credit cards, reward programs, and online payments processors is a touch odd. For now, we can wait for further reports to come out and keep an eye out on the payments trends for ourselves. There is, no doubt, so much to discuss.

If you have any views or feedback to share on the topic, feel free to add a response below or to share your thoughts with me over Linkedin. In case you feel your friends or family would be interested in reading about payments, feel free to share the blog with them as well. See you in a couple of weeks!